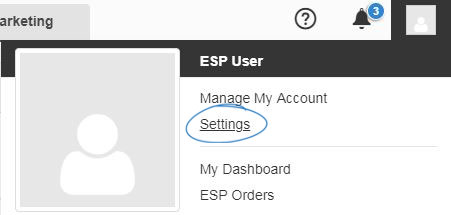

Administrators can add sales tax rates for all users in their company to use on their sales documentation in ESP Orders. To set up or manage your tax rates, go to your Avatar and click on the Settings link.

Next, click on Sales Tax from the options on the left.

In the tax rate area, you can add sales tax rates for every location in which you have a nexus. A nexus is a location in which you do business. For example, if you have a nexus in Pennsylvania, you can establish and manage a sales tax rate for all business you conduct in that state.

Important: It is your company's responsibility to include all states in which you conduct business.

For more information on how taxes are to by collected may be impacted by a decision from the United States Supreme Court, please click here.

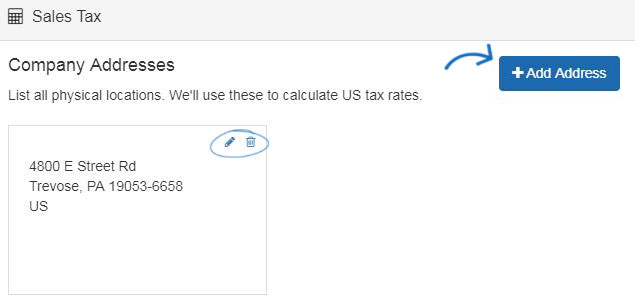

In the Company Addresses section, the physical address shown will be the address from your ESP Account. You can add an additional address by clicking on the Add Address button. You can also edit the address by clicking on the pencil icon or removing the address.

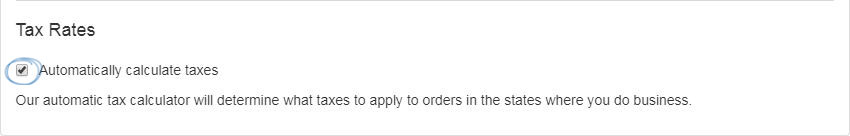

In Tax Rates section, check the "Automatically calculate taxes" to have the system determine the tax rate. Enabling the automatically calculate taxes option ensures that you are including the most up to date tax rate. The tax rate is based on the zip code of the final destination. For example, if you are shipping from Pittsburgh to Philadelphia, the Philadelphia sales tax will be applied to the order. If the sales tax is not applying correctly, make sure that the state code is entered using capital letters and the country is set as United States in both the CRM record for the customer and the Sales Tax settings.

If you wish to charge tax on shipping rates, click in the checkbox below Tax Calculations.

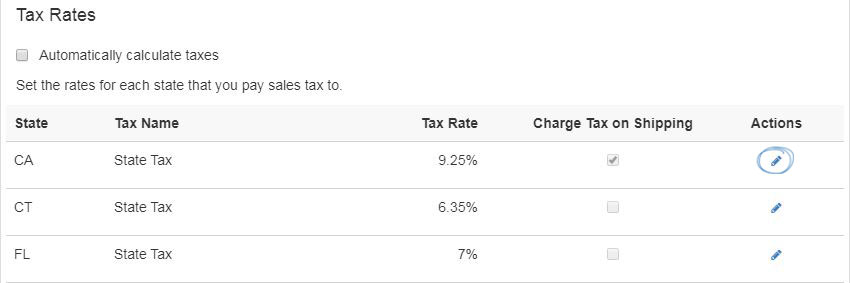

If you want to establish your own tax rates, uncheck the Automatically calculate taxes box. A state tax will appear for each nexus you have established. Click on the pencil icon under actions to modify the tax name and tax rate. Tax rates can only be entered on the state level. You are also able to add a zip code extension, which is the four additional digits after the main five digit zip code. To determine sales tax or locate a four digit extension, these resources are available:

After selecting to have the tax rate automatically calculated or setting the tax rate manually, taxes will automatically be charged on qualifying orders created using ESP Orders or placed on your ESP Website.

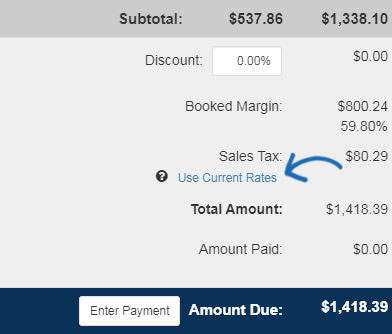

Orders which were created prior to the availability of the automatic tax rate service can be updated using the "Use Current Rates" link on the order.

The order will be updated to reflect the current tax rate and will override any previously existing tax rate applied to the order.

Enabling Tax Rates on an ESP Website

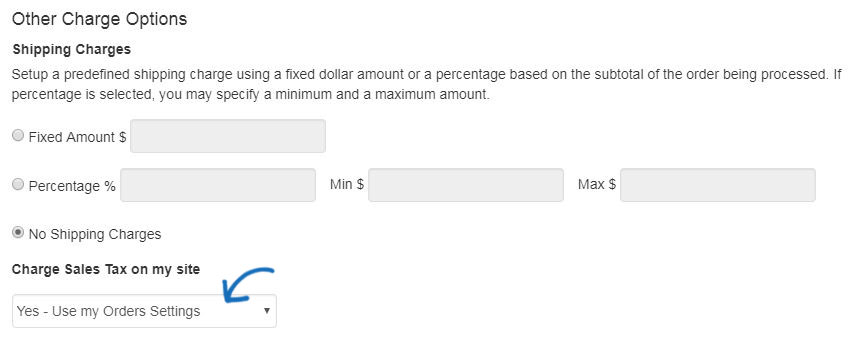

To collect sales tax on your ESP Website, go to the ESP Websites Admin and select Edit for the site you on which you want to enable tax. Expand the Website Settings section, click on the eCommerce option.

In the Other Charge Options section, use the Charge Sales Tax on my site dropdown to select Yes – Use my Orders Settings. You can use an online percentage calculator for assistance with determining calculations.

Français

Français Español

Español